PCI DSS is intended for all entities that store, process, or transmit cardholder data (CHD) and/or sensitive authentication data (SAD) or could impact the security of the cardholder data environment (CDE). This includes all entities involved in payment card account processing —

including merchants, processors, acquirers, issuers, and other service providers.

Whether any entity is required to comply with or validate their compliance to PCI DSS is at the discretion of those organizations that manage compliance programs (such as payment brands and acquirers). Contact the organizations of interest for any additional criteria.

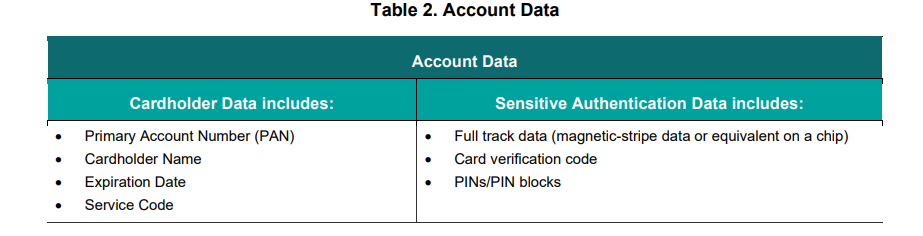

Defining Account Data, Cardholder Data, and Sensitive Authentication Data

Cardholder data and sensitive authentication data are considered account data and are defined as follows:

PCI DSS requirements apply to entities with environments where account data (cardholder data and/or sensitive authentication data) is stored, processed, or transmitted, and entities with environments that can impact the security of the CDE. Some PCI DSS requirements may also apply to entities with environments that do not store, process, or transmit account data – for example, entities that outsource payment operations or management of their CDE 1. Entities that outsource their payment environments or payment operations to third parties remain responsible for ensuring that the account data is protected by the third party per applicable PCI DSS requirements. The primary account number (PAN) is the defining factor for cardholder data. The term account data therefore covers the following: the full PAN, any other elements of cardholder data that are present with the PAN, and any elements of sensitive authentication data.

If cardholder name, service code, and/or expiration date are stored, processed, or transmitted with the PAN, or are otherwise present in the CDE, they must be protected in accordance with the PCI DSS requirements applicable to cardholder data.

If an entity stores, processes, or transmits PAN, then a CDE exists to which PCI DSS requirements will apply. Some requirements may not be applicable, for example if the entity does not store PAN, then the requirements relating to the protection of stored PAN in Requirement 3 will not be applicable to the entity. Even if an entity does not store, process, or transmit PAN, some PCI DSS requirements may still apply. Consider the following:

If the entity stores SAD, requirements specifically related to SAD storage in Requirement 3 will be applicable.

If the entity engages third-party service providers to store, process or transmit PAN on its behalf, requirements related to the management of service providers in Requirement 12 will be applicable.

If the entity can impact the security of a CDE because the security of an entity’s infrastructure can affect how cardholder data is processed (for example, via a web server that controls the generation of a payment form or page) some requirements will be applicable.

If cardholder data is only present on physical media (for example paper), requirements relating to the security and disposal of physical media in Requirement 9 will be applicable.

Requirements related to an incident response plan are applicable to all entities, to ensure that there are procedures to follow in the event of a suspected or actual breach of the confidentiality of cardholder data.

Use of Account Data, Sensitive Authentication Data, Cardholder Data, and Primary Account Number in PCI DSS

PCI DSS includes requirements that specifically refer to account data, cardholder data, and sensitive authentication data. It is important to note that each of these types of data are different and the terms are not interchangeable. Specific references within requirements to account data, cardholder data, or sensitive authentication data are purposeful, and the requirements apply specifically to the type of data that is referenced

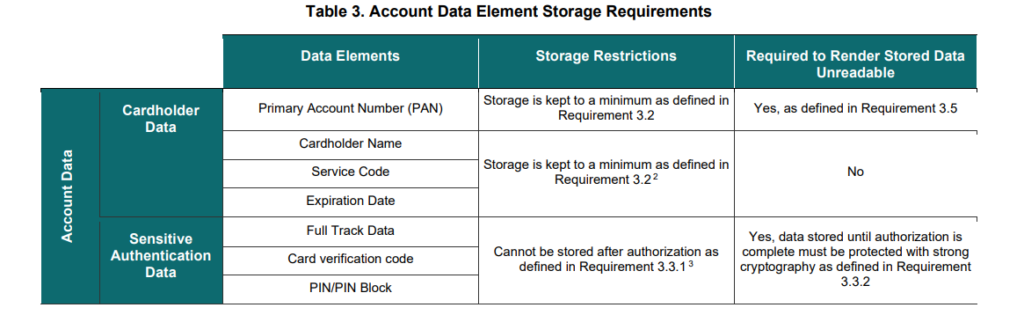

Elements of Account Data and Storage Requirements

Table 3 identifies the elements of cardholder and sensitive authentication data, whether storage of each data element is permitted or prohibited, and whether each data element must be rendered unreadable—for example, with strong cryptography—when stored. This table is not exhaustive and is presented to illustrate only how the stated requirements apply to the different data elements.

If PAN is stored with other elements of cardholder data, only the PAN must be rendered unreadable according to PCI DSS Requirement 3.5.1. Sensitive authentication data must not be stored after authorization, even if encrypted. This applies even for environments where there is no PAN present.