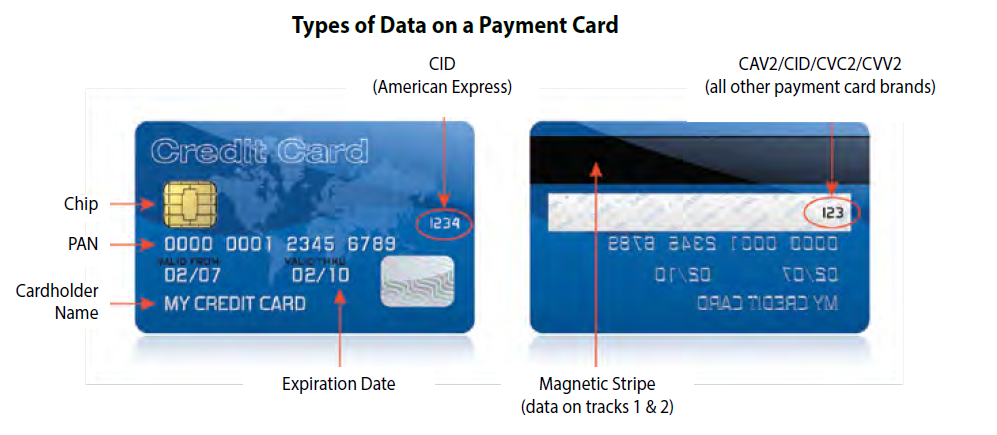

The goal of the PCI Data Security Standard (PCI DSS) is to protect cardholder data and sensitive authentication data wherever it is processed, stored or transmitted. The security controls and processes required by PCI DSS are vital for protecting all payment card account data, including the PAN – the primary account number printed on the front of a payment card. Merchants, service providers, and other entities involved with payment card processing must never store sensitive authentication data after authorization. This includes the 3- or 4- digit security code printed on the front or back of a card, the data stored on a card’s magnetic stripe or chip (also called “Full Track Data”) – and personal identification numbers (PIN) entered by the cardholder. This chapter presents the objectives of PCI DSS and related 12 requirements.

Build and Maintain a Secure Network and Systems

In the past, theft of financial records required a criminal to physically enter an organization’s business site. Now, many payment card transactions use PIN entry devices and computers connected by networks. By using network security controls, entities can prevent criminals from virtually accessing payment system networks and stealing cardholder data and/or sensitive authentication data.

Requirement 1: Install and maintain a firewall configuration to protect cardholder data

Firewalls are devices that control computer traffic allowed into and out of an organization’s network, and into sensitive areas within its internal network. Firewall functionality can also appear in other system components. Routers are hardware or software that connects two or more networks. All such networking devices are in scope for assessment of Requirement 1 if used within the cardholder data environment. 1.1 Establish and implement firewall and router configuration standards that formalize testing whenever configurations change; that identify all connections between the cardholder data environment and other networks (including wireless) with documentation and diagrams; that document business justification and various technical settings for each implementation; that diagram all cardholder data flows across systems and networks; and stipulate a review of configuration rule sets at least every six months.

1.2 Build firewall and router configurations that restrict all traffic, inbound and outbound, from “untrusted” networks (including wireless) and hosts, and specifically deny all other traffic except for protocols necessary for the cardholder data environment.

1.3 Prohibit direct public access between the Internet and any system component in the cardholder data environment.

1.4 Install personal firewall software or equivalent functionality on any devices (including company and/or employee owned) that connect to the Internet when outside the network (for example, laptops used by employees), and which are also used to access the cardholder data environment.

1.5 Ensure that related security policies and operational procedures are documented, in use, and known to all affected parties.

Requirement 2: Do not use vendor-supplied defaults for system passwords and other

security parameters

The easiest way for a hacker to access your internal network is to try default passwords or exploits based on default system software settings in your payment card infrastructure. Far too often, merchants do not change default passwords or settings upon deployment. This is similar to leaving your store physically unlocked when you go home for the night. Default passwords and settings for most network devices are widely known. This information, combined with hacker tools that show what devices are on your network can make unauthorized entry a simple task if you have failed to change the default settings.

2.1 Always change ALL vendor-supplied defaults and remove or disable unnecessary default accounts before installing a system on the network. This includes wireless devices that are connected to the cardholder data environment or are used to transmit cardholder data.

2.2 Develop configuration standards for all system components that address all known security vulnerabilities and are consistent with industry-accepted definitions. Update system configuration standards as new vulnerability issues are identified.

2.3 Using strong cryptography, encrypt all non-console administrative access.

2.4 Maintain an inventory of system components that are in scope for PCI DSS.

2.5 Ensure that related security policies and operational procedures are documented, in use, and known to all affected parties.

2.6 Shared hosting providers must protect each entity’s hosted environment and cardholder data (details are in PCI DSS Appendix A1: “Additional PCI DSS Requirements for Shared Hosting Providers.”)

Protect Cardholder Data

Cardholder data refers to any information printed, processed, transmitted or stored in any form on a payment card. Entities accepting payment cards are expected to protect cardholder data and to prevent its unauthorized use – whether the data is printed or stored locally, or transmitted over an internal or public network to a remote server or service provider.

Requirement 3: Protect stored cardholder data

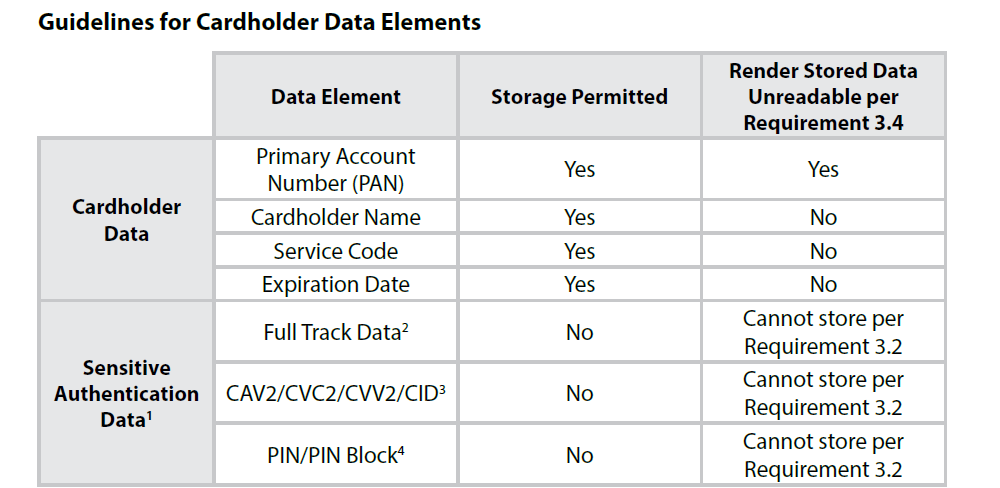

Cardholder data should not be stored unless it’s necessary to meet the needs of the business. Sensitive data on the magnetic stripe or chip must never be stored after authorization. If your organization stores PAN, it is crucial to render it unreadable (see 3.4, and table below for guidelines).

3.1 Limit cardholder data storage and retention time to that which is required for business, legal, and/ or regulatory purposes, as documented in your data retention policy. Purge unnecessary stored data at least quarterly.

3.2 Do not store sensitive authentication data after authorization (even if it is encrypted). See table below. Render all sensitive authentication data unrecoverable upon completion of the authorization process. Issuers and related entities may store sensitive authentication data if there is a business justification, and the data is stored securely.

3.3 Mask PAN when displayed (the first six and last four digits are the maximum number of digits you may display), so that only authorized people with a legitimate business need can see more than the first six/last four digits of the PAN. This does not supersede stricter requirements that may be in place for displays of cardholder data, such as on a point-of-sale receipt.

3.4 Render PAN unreadable anywhere it is stored – including on portable digital media, backup media, in logs, and data received from or stored by wireless networks. Technology solutions for this requirement may include strong one-way hash functions of the entire PAN, truncation, index tokens with securely stored pads, or strong cryptography. (See PCI DSS Glossary for definition of

strong cryptography.) 3.5 Document and implement procedures to protect any keys used for encryption of cardholder data from disclosure and misuse.

3.6 Fully document and implement key management processes and procedures for cryptographic keys used for encryption of cardholder data.

3.7 Ensure that related security policies and operational procedures are documented, in use, and known to all affected parties.

Requirement 4: Encrypt transmission of cardholder data across open, public networks

Cyber criminals may be able to intercept transmissions of cardholder data over open, public networks so it is important to prevent their ability to view this data. Encryption is one technology that can be used to render transmitted data unreadable by any unauthorized person.

4.1 Use strong cryptography and security protocols to safeguard sensitive cardholder data during transmission over open, public networks (e.g. Internet, wireless technologies, cellular technologies, General Packet Radio Service [GPRS], satellite communications). Ensure wireless networks transmitting cardholder data or connected to the cardholder data environment use industry best practices to implement strong encryption for authentication and transmission.

4.2 Never send unprotected PANs by end user messaging technologies (for example, e-mail, instant messaging, SMS, chat, etc.).

4.3 Ensure that related security policies and operational procedures are documented, in use, and known to all affected parties.

Maintain a Vulnerability Management Program

Vulnerability management is the process of systematically and continuously finding weaknesses in an entity’s payment card infrastructure system. This includes security procedures, system design, implementation, or internal controls that could be exploited to violate system security policy.

Requirement 5: Protect all systems against malware and regularly update anti-virus software or programs

Malicious software (a.k.a “malware”) exploits system vulnerabilities after entering the network via users’ e-mail and other online business activities. Anti-virus software must be used on all systems commonly affected by malware to protect systems from current and evolving malicious software threats. Additional anti-malware solutions may supplement (but not replace) anti-virus software.

5.1 Deploy anti-virus software on all systems commonly affected by malicious software (particularly personal computers and servers). For systems not affected commonly by malicious software, perform periodic evaluations to evaluate evolving malware threats and confirm whether such systems continue to not require anti-virus software.

5.2 Ensure that all anti-virus mechanisms are kept current, perform periodic scans, generate audit logs, which are retained per PCI DSS Requirement 10.7.

5.3 Ensure that anti-virus mechanisms are actively running and cannot be disabled or altered by users, unless specifically authorized by management on a case-by-case basis for a limited time period.

5.4 Ensure that related security policies and operational procedures are documented, in use, and known to all affected parties.

Requirement 6: Develop and maintain secure systems and applications

Security vulnerabilities in systems and applications may allow criminals to access PAN and other cardholder data. Many of these vulnerabilities are eliminated by installing vendor-provided security patches, which perform a quick-repair job for a specific piece of programming code. All critical systems must have the most recently released software patches to prevent exploitation. Entities should apply patches to less-critical systems as soon as possible, based on a risk-based vulnerability management program. Secure coding practices for developing applications, change control procedures and other secure software development practices should always be followed.

6.1 Establish a process to identify security vulnerabilities, using reputable outside sources, and assign a risk ranking (e.g. “high,” “medium,” or “low”) to newly discovered security vulnerabilities.

6.2 Protect all system components and software from known vulnerabilities by installing applicable vendor-supplied security patches. Install critical security patches within one month of release.

6.3 Develop internal and external software applications including web-based administrative access to applications in accordance with PCI DSS and based on industry best practices. Incorporate information security throughout the software development life cycle. This applies to all software developed internally as well as bespoke or custom software developed by a third party. 6.4 Follow change control processes and procedures for all changes to system components. Ensure all relevant PCI DSS requirements are implemented on new or changed systems and networks after significant changes.

6.5 Prevent common coding vulnerabilities in software development processes by training developers in secure coding techniques and developing applications based on secure coding guidelines – including how sensitive data is handled in memory.

6.6 Ensure all public-facing web applications are protected against known attacks, either by performing application vulnerability assessment at least annually and after any changes, or by installing an automated technical solution that detects and prevents web-based attacks (for example, a web-application firewall) in front of public-facing web applications, to continually check all traffic.

6.7 Ensure that related security policies and operational procedures are documented, in use, and known to all affected parties.

Implement Strong Access Control Measures

Access-controls allow merchants to permit or deny the use of physical or technical means to access PAN and other cardholder data. Access must be granted on a business need-to-know basis. Physical access controls entail the use of locks or other means to restrict access to computer media, paper-based records or system hardware. Logical access controls permit or deny use of payment devices, wireless networks, PCs and other computing devices, and also controls access to digital files containing cardholder data.

Requirement 7: Restrict access to cardholder data by business need-to-know

To ensure critical data can only be accessed by authorized personnel, systems and processes must be in place to limit access based on need to know and according to job responsibilities. Need to know is when access rights are granted to only the least amount of data and privileges needed to perform a job.

7.1 Limit access to system components and cardholder data to only those individuals whose job requires such access. 7.2 Establish an access control system(s) for systems components that restricts access based on a user’s need to know, and is set to “deny all” unless specifically allowed.

7.3 Ensure that related security policies and operational procedures are documented, in use, and known to all affected parties.

Requirement 8: Identify and authenticate access to system components

Assigning a unique identification (ID) to each person with access ensures that actions taken on critical data and systems are performed by, and can be traced to, known and authorized users. Requirements apply to all accounts, including point of sale accounts, with administrative capabilities and all accounts with access to stored cardholder data. Requirements do not apply to accounts used by consumers (e.g., cardholders).

8.1 Define and implement policies and procedures to ensure proper user identification management for users and administrators on all system components. Assign all users a unique user name before allowing them to access system components or cardholder data.

8.2 Employ at least one of these to authenticate all users: something you know, such as a password or passphrase; something you have, such as a token device or smart card; or something you are, such as a biometric. Use strong authentication methods and render all passwords/passphrases unreadable during transmission and storage using strong cryptography.

8.3 Secure all individual non-console administrative access and all remote access to the cardholder data environment using multi-factor authentication. This requires at least two of the three authentication methods described in 8.2 are used for authentication. Using one factor twice (e.g. using two separate passwords) is not considered multi-factor authentication. This requirement applies to administrative personnel with non-console access to the CDE from within the entity’s network, and all remote network access (including for users, administrators, and third-parties) originating from outside the entity’s network. 8.4 Develop, implement, and communicate authentication policies and procedures to all users.

8.5 Do not use group, shared, or generic IDs, or other authentication methods. Service providers with access to customer environments must use a unique authentication credential (such as a password/passphrase) for each customer environment.

8.6 Use of other authentication mechanisms such as physical security tokens, smart cards, and certificates must be assigned to an individual account.

8.7 All access to any database containing cardholder data must be restricted: all user access must be through programmatic methods; only database administrators can have direct or query access; and application IDs for database applications can only be used by the applications (and not by users or non-application processes).

8.8 Ensure that related security policies and operational procedures are documented, in use, and known to all affected parties.

Requirement 9: Restrict physical access to cardholder data

Any physical access to data or systems that house cardholder data provides the opportunity for persons to access and/or remove devices, data, systems or hardcopies, and should be appropriately restricted. “Onsite personnel” are full- and part-time employees, temporary employees, contractors, and consultants who are physically present on the entity’s premises. “Visitors” are vendors and guests that enter the facility for a short duration – usually up to one day. “Media” is all paper and electronic media containing cardholder data.

9.1 Use appropriate facility entry controls to limit and monitor physical access to systems in the cardholder data environment.

9.2 Develop procedures to easily distinguish between onsite personnel and visitors, such as assigning ID badges.

9.3 Control physical access for onsite personnel to the sensitive areas. Access must be authorized and based on individual job function; access must be revoked immediately upon termination, and all physical access mechanisms, such as keys, access cards, etc. returned or disabled. 9.4 Ensure all visitors are authorized before entering areas where cardholder data is processed or maintained, given a physical badge or other identification that expires and identifies visitors as not onsite personnel, and are asked to surrender the physical badge before leaving the facility or at the date of expiration. Use a visitor log to maintain a physical audit trail of visitor information and activity, including visitor name, company, and the onsite personnel authorizing physical access.

Retain the log for at least three months unless otherwise restricted by law.

9.5 Physically secure all media; store media back-ups in a secure location, preferably off site.

9.6 Maintain strict control over the internal or external distribution of any kind of media.

9.7 Maintain strict control over the storage and accessibility of media.

9.8 Destroy media when it is no longer needed for business or legal reasons.

9.9 Protect devices that capture payment card data via direct physical interaction with the card from tampering and substitution. This includes periodic inspections of POS device surfaces to detect tampering, and training personnel to be aware of suspicious activity.

9.10 Ensure that related security policies and operational procedures are documented, in use, and known to all affected parties.

Regularly Monitor and Test Networks

Physical and wireless networks are the glue connecting all endpoints and servers in the payment infrastructure. Vulnerabilities in network devices and systems present opportunities for criminals to gain unauthorized access to payment card applications and cardholder data. To prevent exploitation, organizations must regularly monitor and test networks to find and fix vulnerabilities.

Requirement 10: Track and monitor all access to network resources and cardholder data

Logging mechanisms and the ability to track user activities are critical for effective forensics and vulnerability management. The presence of logs in all environments allows thorough tracking and analysis if something goes wrong. Determining the cause of a compromise is very difficult without system activity logs. 10.1 Implement audit trails to link all access to system components to each individual user.

10.2 Implement automated audit trails for all system components for reconstructing these events: all individual user accesses to cardholder data; all actions taken by any individual with root or administrative privileges; access to all audit trails; invalid logical access attempts; use of and changes to identification and authentication mechanisms (including creation of new accounts, elevation of privileges), and all changes, additions, deletions to accounts with root or administrative privileges; initialization, stopping or pausing of the audit logs; creation and deletion of system-level objects.

10.3 Record audit trail entries for all system components for each event, including at a minimum: user identification, type of event, date and time, success or failure indication, origination of event, and identity or name of affected data, system component or resource.

10.4 Using time synchronization technology, synchronize all critical system clocks and times and implement controls for acquiring, distributing, and storing time.

10.5 Secure audit trails so they cannot be altered.

10.6 Review logs and security events for all system components to identify anomalies or suspicious activity. Perform critical log reviews at least daily.

10.7 Retain audit trail history for at least one year; at least three months of history must be immediately available for analysis.

10.8 Service providers must implement a process for timely detection and reporting of failures of critical security control systems.

10.9 Ensure that related security policies and operational procedures are documented, in use, and known to all affected parties.

Requirement 11: Regularly test security systems and processes

Vulnerabilities are being discovered continually by malicious individuals and researchers, and being introduced by new software. System components, processes, and custom software should be tested frequently to ensure security is maintained over time. Testing of security controls is especially important for any environmental changes such as deploying new software or changing system configurations.

11.1 Implement processes to test for the presence of wireless access points (802.11) and detect and identify all authorized and unauthorized wireless access points on a quarterly basis. Maintain an inventory of authorized wireless access points and implement incident response procedures in the event unauthorized wireless access points are detected.

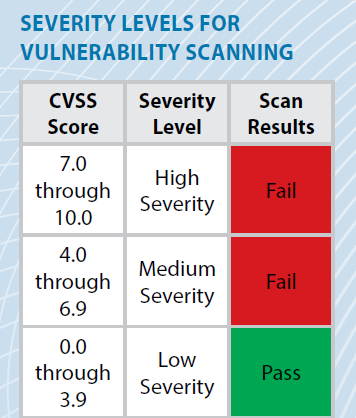

11.2 Run internal and external network vulnerability scans at least quarterly and after any significant change in the network. Address vulnerabilities and perform rescans as needed, until passing scans are achieved. After passing a scan for initial PCI DSS compliance, an entity must, in subsequent years, complete four consecutive quarters of passing scans. Quarterly external scans must be performed by an Approved Scanning Vendor (ASV). Scans conducted after network changes and internal scans may be performed by internal staff.

11.3 Develop and implement a methodology for penetration testing that includes external and internal penetration testing at least annually and after any significant upgrade or modification. If segmentation is used to reduce PCI DSS scope, perform penetration tests at least annually to verify the segmentation methods are operational and effective. Service providers using segmentation

must confirm PCI DSS scope by performing penetration testing on segmentation controls at least every six months and after making changes to these controls.

11.4 Use network intrusion detection and/or intrusion prevention techniques to detect and/or prevent intrusions into the network. Monitor all traffic at the perimeter of the cardholder data environment as well as at critical points inside of the cardholder data environment, and alert personnel to suspected compromises. IDS/IPS engines, baselines, and signatures must be kept up to date.

environment. For external scans, none of those components may contain any vulnerability that has been assigned a Common Vulnerability Scoring System (CVSS) base score equal to or higher than 4.0.”

11.5 Deploy a change detection mechanism (for example, file integrity monitoring tools) to alert personnel to unauthorized modification (including changes, additions, and deletions) of critical system files, configuration files or content files. Configure the software to perform critical file comparisons at least weekly. Implement a process to respond to any alerts generated by the

change-detection solution.

11.6 Ensure that related security policies and operational procedures are documented, in use, and known to all affected parties.

Maintain an Information Security Policy

A strong security policy sets the tone for security affecting an organization’s entire company, and it informs employees of their expected duties related to security. All employees should be aware of the sensitivity of cardholder data and their responsibilities for protecting it.

Requirement 12: Maintain a policy that addresses information security for all personnel

12.1 Establish, publish, maintain, and disseminate a security policy; review the security policy at least annually and update when the environment changes.

12.2 Implement a risk assessment process that is performed at least annually and upon significant changes to the environment that identifies critical assets, threats, and vulnerabilities, and results in a formal assessment.

12.3 Develop usage policies for critical technologies to define their proper use by all personnel. These include remote access, wireless, removable electronic media, laptops, tablets, handheld devices, email and Internet.

12.4 Ensure that the security policy and procedures clearly define information security responsibilities for all personnel. Service providers must also establish responsibility for their executive management for the protection of cardholder data and a PCI DSS compliance program 12.5 Assign to an individual or team information security responsibilities defined by 12.5 subsections.

12.6 Implement a formal security awareness program to make all personnel aware of the cardholder data security policy and procedures.

12.7 Screen potential personnel prior to hire to minimize the risk of attacks from internal sources. Example screening includes previous employment history, criminal record, credit history, and reference checks.

12.8 Maintain and implement policies and procedures to manage service providers with which cardholder data is shared, or that could affect the security of cardholder data.

12.9 Service providers acknowledge in writing to customers that they are responsible for the security of cardholder data that they possess or otherwise store, process, or transmit on behalf of the customer, or to the extent they could impact the security of the customer’s cardholder data environment.

12.10 Implement an incident response plan. Be prepared to respond immediately to a system breach.

12.11 Service providers must perform and document reviews at least quarterly to confirm personnel are following security policies and operational procedures.

Compensating Controls for PCI DSS Requirements

Compensating controls may be considered for most PCI DSS requirements when an entity cannot meet a requirement explicitly as stated, due to legitimate technical or documented business constraints, but has sufficiently mitigated the risk associated with the requirement through implementation of compensating controls. In order for a compensating control to be considered valid, it must be reviewed by an assessor. The effectiveness of a compensating control is dependent on the specifics of the environment in which the control is implemented, the surrounding security controls, and the configuration of the control. Entities should be aware that a particular compensating control will not be effective in all environments. See PCI DSS Appendices B and C for details.

People also ask this Questions

- What is a defense in depth security strategy how is it implemented?

- What is AWS Solution Architect?

- What is the role of AWS Solution Architect?

- Is AWS Solution Architect easy?

- What is AWS associate solutions architect?

- Is AWS Solutions Architect Associate exam hard?

Infocerts, 5B 306 Riverside Greens, Panvel, Raigad 410206 Maharashtra, India

Contact us – https://www.infocerts.com